A seamless start to your

solar future

EXPERT SOLAR + STORAGE INSTALLATION FROM PEOPLE WHO CARE

ABOUT TREATING YOU RIGHT

Reduce your

carbon footprint

Shrink your

electric bill

Go solar with

confidence

Reduce your carbon footprint

Shrink your electric bill

Go solar with confidence

Does installing solar feel a little daunting?

It’s a big investment in your future

You may not be an expert in solar photovoltaics

There are a lot of details to get right

Will your solar installer look out for you?

At A&R Solar our #1 focus is on your best interests

Comfortable consultations

From your initial phone call about your solar installation to your design consultation, we listen & educate so you can make the best decision for you

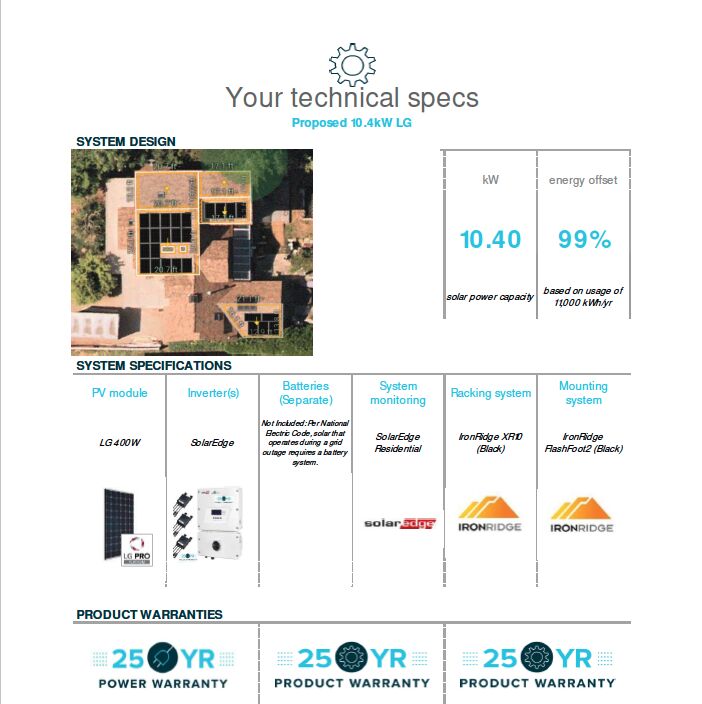

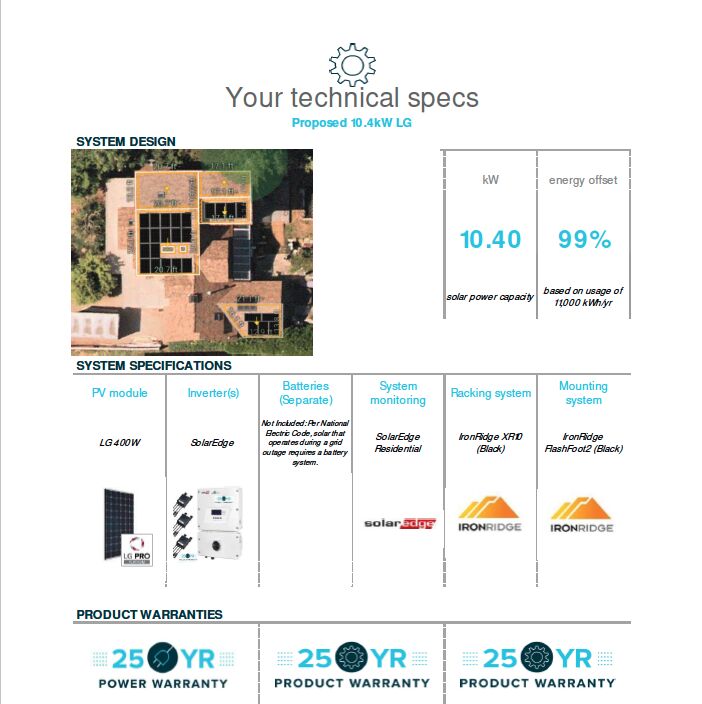

Data-driven designs

Your custom design comes with real evidence that it can meet your energy production goals while making good financial sense

Excellence in craftsmanship

Your solar installation is backed by our Perfect 10 Guarantee and handled by friendly experts who respect your time and property

We get it – going solar is a big deal, and not every company will inspire your complete confidence

Integrity and genuineness in every customer interaction

Industry-leading expertise & craftsmanship

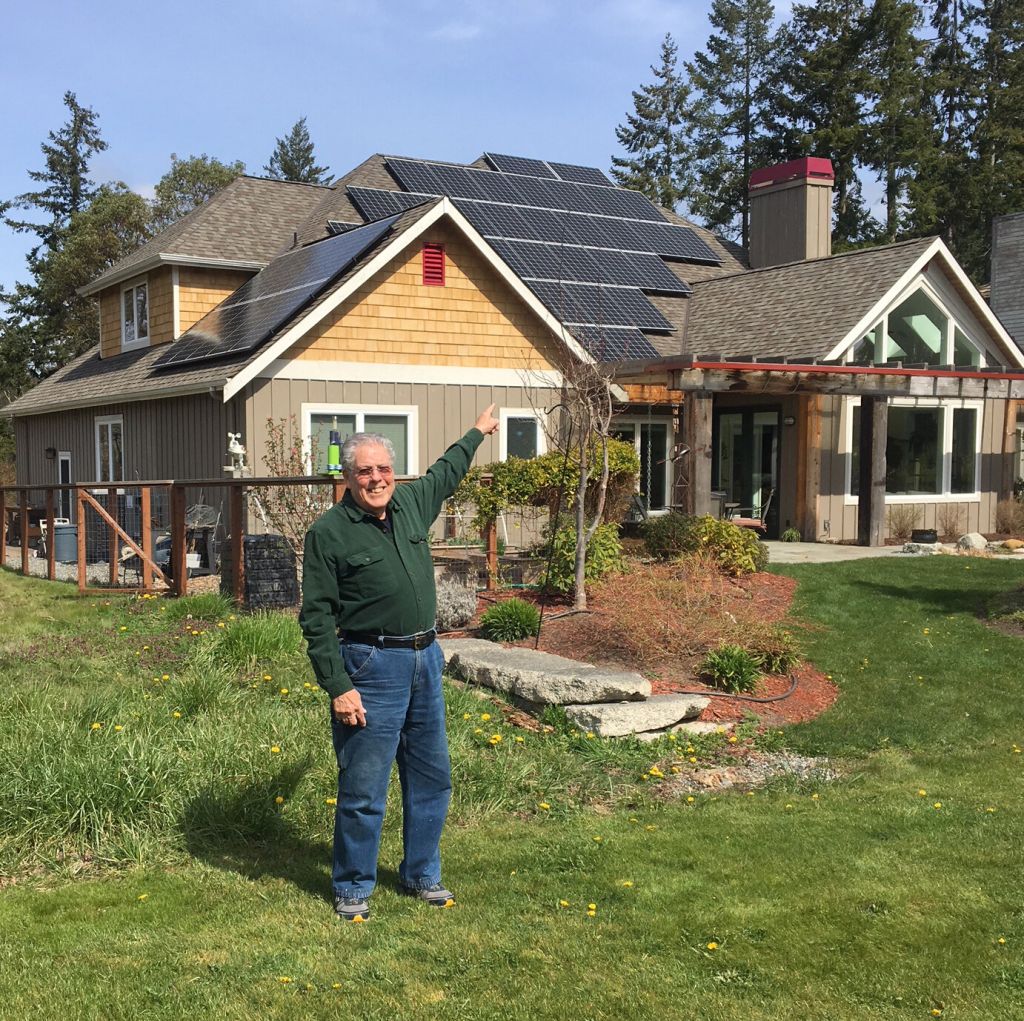

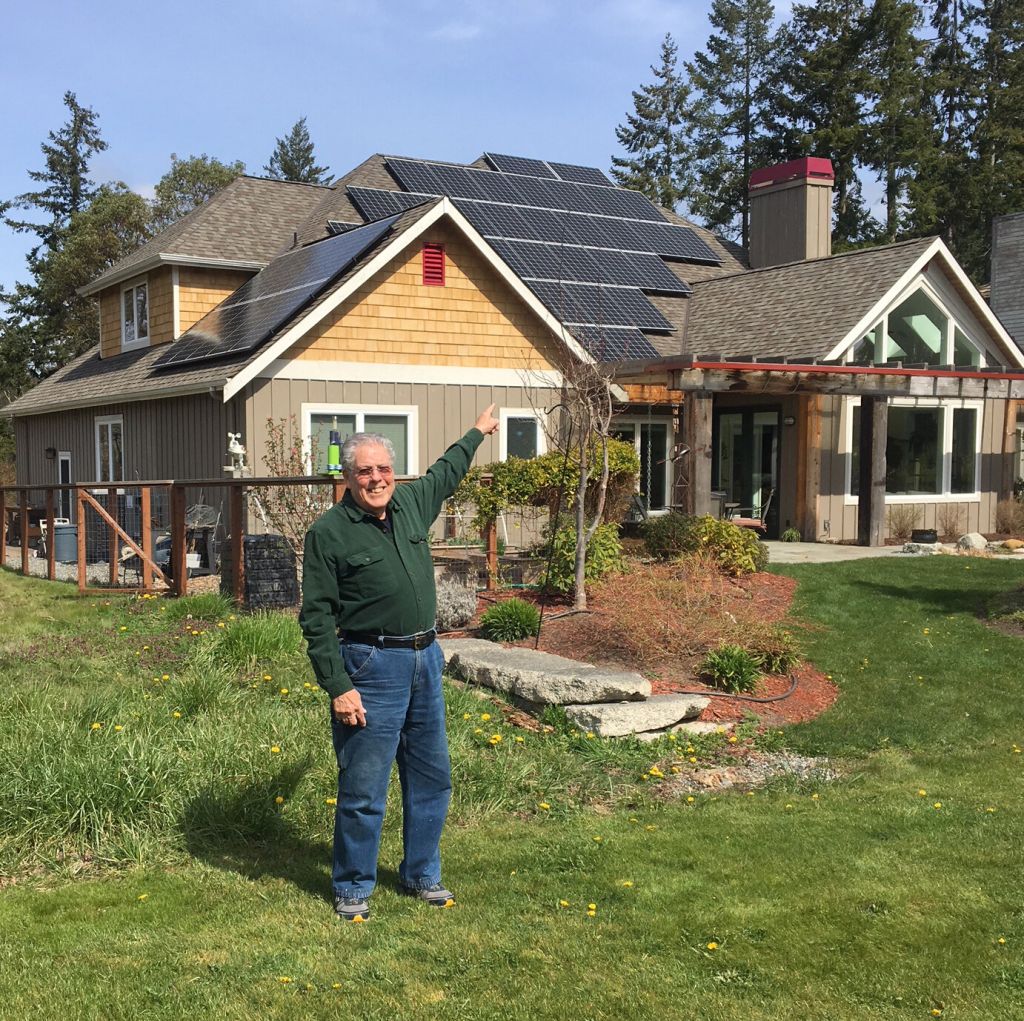

Since 2007, we’ve delighted over 4,000 home and business owners with our exceptional service and solar energy production they love to show their friends.

Ready to get started?

HERE’S HOW IT WORKS

1. Request a quote

Tell us about your project using the form below. A friendly Solar Education Associate will contact you to see if we’re a good fit for you as a solar installer.

2. Get a custom design

Your Design Consultant will meet with you to create a free design that hits your production goals and makes good financial sense. You decide when to move forward.

3. Go solar!

From permits to solar installation to final inspections, we’ll take care of everything. You just flip the switch and watch your electric bill and carbon footprint shrink.

Our commitment to quality & service

SOLAR INSTALLATION IS A BIG PROJECT WITH A LOT OF UNKNOWNS FOR MOST OF OUR CUSTOMERS

At A&R Solar, we know it takes more than just expertise and a history of quality craftsmanship to instill confidence. That’s why we go out of our way to treat every customer with the respect and humanness they expect and deserve. Since Andy Yatteau and Reeves Clippard (the A&R) founded the company in 2007, we’ve kept the same promises to every customer:

- We’ll show up when we say we’re going to.

- We’ll do what we say we’re going to.

- We’ll communicate professionally if any complications arise.

If that sounds different from most contractors you’ve worked with, that’s on purpose. As one of the Northwest’s oldest solar installers, we invite you to request a quote today. See how enjoyable it can be to make the world a little greener, and your electric bill a lot smaller!

“We believe an investment in solar today ensures a better energy future tomorrow, and for generations.”

Solar in the northwest

Long, sunny summer days and cool year-round temperatures lead to optimal performance of this clean energy solution.

Battery storage pros & cons

If you experience frequent outages, solar batteries can keep the lights on. A&R Solar is a Tesla Powerwall Certified Installer.

Current solar incentives

Federal and state incentives and rebates can help make going solar more affordable. See options for Washington and Oregon.